Why Verifacto?

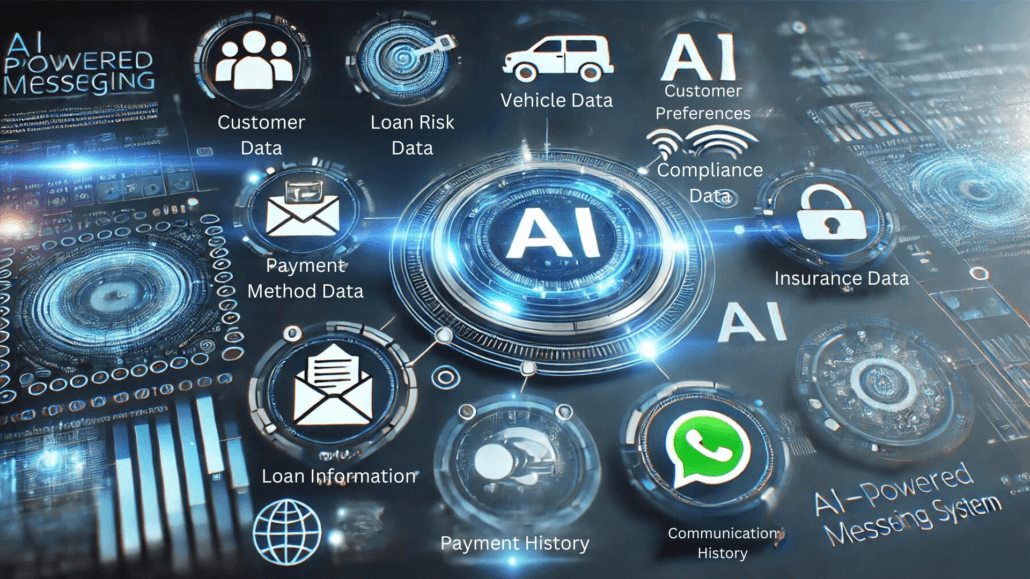

Q&A: The All-in-One DMS & LMS for BHPH Dealers and Finance Companies Q: What makes Verifacto different from other DMS or LMS systems?Verifacto is a unified platform built specifically for Buy Here Pay Here (BHPH) dealerships and auto finance companies. It combines Dealer Management (DMS), Loan Management (LMS), insurance tracking, payment processing, and automated customer […]

How to Choose a DMS Without Getting Stuck Later

Picking the right Dealer Management System (DMS) isn’t just about features—it’s about protecting your business long term. Before you commit, here are five things every dealer should watch out for: 1. No Long-Term Contracts If a system locks you into a 12-month (or longer) contract, ask yourself why. Good platforms let their service speak for […]

Why Verifacto is the Best LMS for Finance Companies

In today’s lending environment, finance companies and Related Finance Companies (RFCs) need more than just a basic loan management system (LMS). They need automation, real-time visibility, compliance tracking, and integrated customer communication — all in one place. That’s exactly what Verifacto delivers. Here’s why Verifacto is the top choice for finance companies and RFCs: 1. […]

Lessons from the Tricolor Bankruptcy: Why Risk Management and Efficiency Matter More Than Ever

The sudden bankruptcy of Tricolor Auto Acceptance sent shockwaves through the auto finance industry. As one of the largest players serving Hispanic borrowers with limited or no credit history, its collapse left lenders, investors, and customers scrambling for answers. While the headlines focus on allegations of fraud and mismanagement, there’s a bigger lesson for the […]

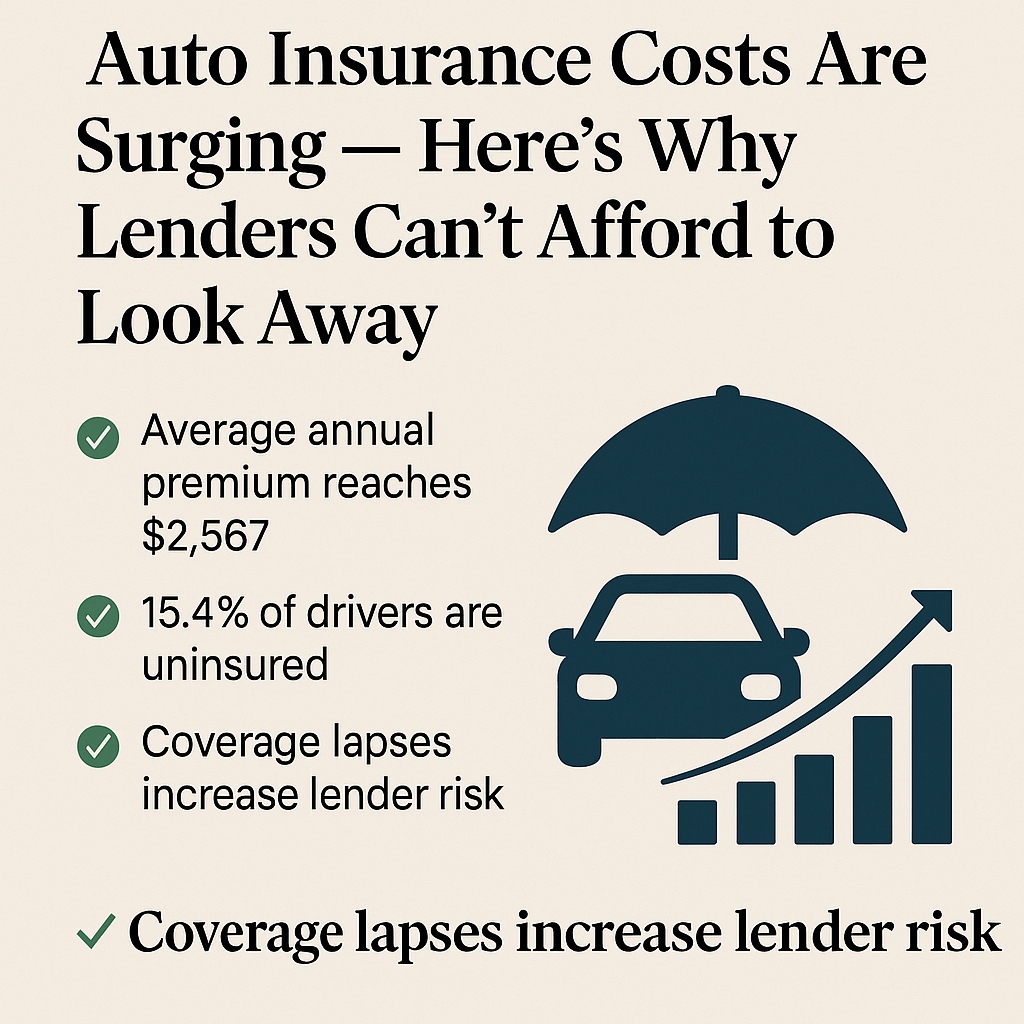

Auto Insurance Costs Are Surging — Here’s What It Means for Lenders and Dealerships

The auto finance industry is facing a new wave of risk. In August, the average annual premium for auto insurance in the U.S. jumped 18% year-over-year to $2,567 — roughly $214 per month. At the same time, the Insurance Research Council reports that 15.4% of U.S. drivers — more than 1 in 7 — are […]

Why Verifacto is the Best DMS for Dealers with a Related Finance Company (RFC)

The Real Challenge for Dealers with an RFC For dealers operating a Related Finance Company (RFC), the biggest problem isn’t just working across multiple systems—it’s using software that simply isn’t designed for the unique needs of an RFC. Many Dealer Management Systems (DMS) on the market fail to address the strict compliance requirements and operational […]

Stop Stitching Systems Together. Start Running Your Business on an All-in-One Dealer Management System

If you’re managing your dealership or finance operation with a mix of disconnected tools and third-party services, you’re not using a system — you’re managing chaos. In today’s fast-moving, regulated environment, dealers need more than just a Dealer Management System (DMS) or a Loan Management System (LMS). They need an all-in-one DMS that brings everything […]

Why an All-in-One Solution Is the Smarter, Safer Choice for Your Business

Too many lenders find out the hard way: their software vendor doesn’t actually control the tools they rely on. When payment systems break, compliance rules shift, or third-party vendors go silent — they’re left scrambling, without support. Verifacto offers an all-in-one solution — everything you need to manage loans, track insurance, process payments, and communicate […]

The Strategic Advantage of Choosing a Unified Platform Over Third-Party Integrations

In today’s competitive and highly regulated business environment, companies must carefully select their technology partners. One of the most important decisions is whether to operate on a platform that truly unifies all core systems — or one that depends on fragmented third-party integrations. Recent developments in the industry — including forced migrations from trusted providers […]

Why Verifacto is the Best DMS for BHPH Dealers

In the world of Buy Here Pay Here (BHPH) auto financing, success depends on more than just selling cars. It requires the right technology—purpose-built to handle subprime lending, compliance, collections, and insurance tracking. That’s where Verifacto stands out. In 2025, Verifacto continues to lead the way with a Dealer Management System (DMS) designed specifically for […]