Revolutionizing Customer Communication for Lenders

Effortless and Effective Communication

At Verifacto, we understand that seamless and effective communication with borrowers is the cornerstone of successful lending operations. That’s why we’ve developed a comprehensive communication system that not only simplifies the process but also enhances the customer experience, ensuring your messages are heard, understood, and acted upon.

Multi-Channel Communication at Your Fingertips

Engage borrowers on the platforms they prefer. With Verifacto, you can reach your customers using:

- Text Messages (SMS): Direct, quick, and effective for urgent reminders and updates.

- Emails: Deliver detailed communications and documentation with ease.

- Phone Calls: Maintain a personal touch when needed for sensitive or complex matters.

- Letters: Cater to customers who prefer traditional correspondence.

- Push Notifications: Instantly notify borrowers via your mobile app.

- WhatsApp: Connect with customers on one of the most popular communication platforms globally.

No matter the channel, Verifacto ensures your messages are delivered seamlessly and in a timely manner.

Verifacto’s LMS is FREE when added to the insurance tracking and payment processing platforms.

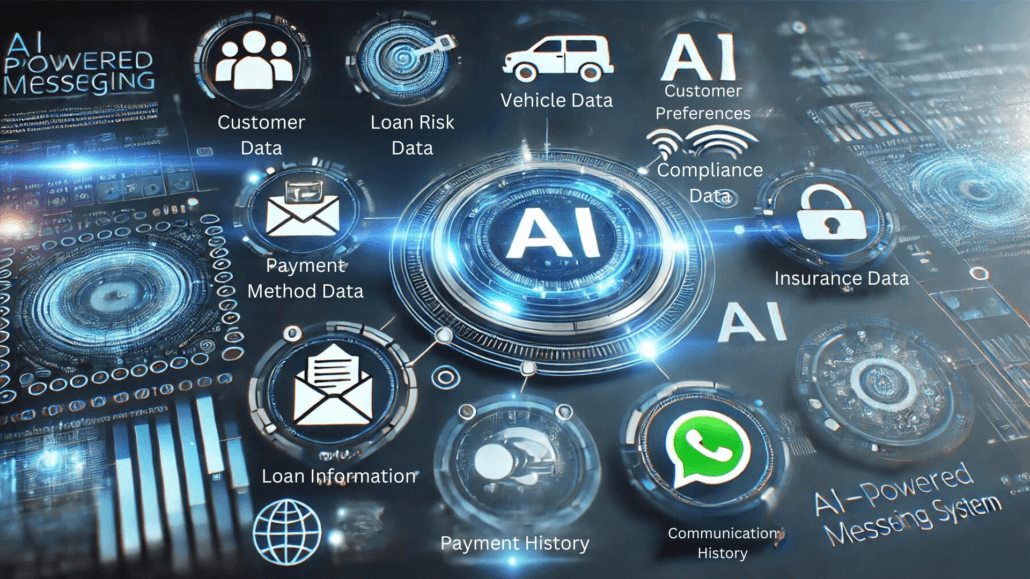

The Power of AI-Driven Personalization

Our AI-powered communication tool takes borrower engagement to the next level by tailoring every message to the unique needs and preferences of your customers.

Here’s how it works:

- Data Analysis: The system analyzes borrower history, payment patterns, and interaction preferences.

- Message Optimization: Based on this data, it recommends message content, tone, and timing for maximum impact.

- Continuous Improvement: With every interaction, the AI learns and adapts, ensuring more effective communications over time.

From adjusting the tone of a payment reminder to personalizing the content of an insurance update, Verifacto’s AI ensures that every message resonates with the recipient.

Why Personalized Communication Matters

Effective communication is not just about sending messages—it’s about delivering the right message to the right person at the right time. Personalized communication:

- Increases borrower engagement and responsiveness.

- Reduces late payments and delinquencies.

- Strengthens customer satisfaction and loyalty.

Compliance Built-In

Verifacto’s communication system is designed to keep your business compliant with all regulatory requirements. From content approvals to message delivery tracking, every aspect of our platform is built with compliance in mind, giving you peace of mind while improving borrower engagement.

At Verifacto, our loan management system does it all so you can focus on what matters most—running your business.

Empower Your Communication with Verifacto

By combining multi-channel communication capabilities with the intelligence of AI-driven personalization, Verifacto empowers lenders to foster stronger borrower relationships, improve payment performance, and drive operational efficiency.

Ready to revolutionize your communication strategy? Contact us today or Schedule a demo to see how Verifacto can transform the way you connect with borrowers.