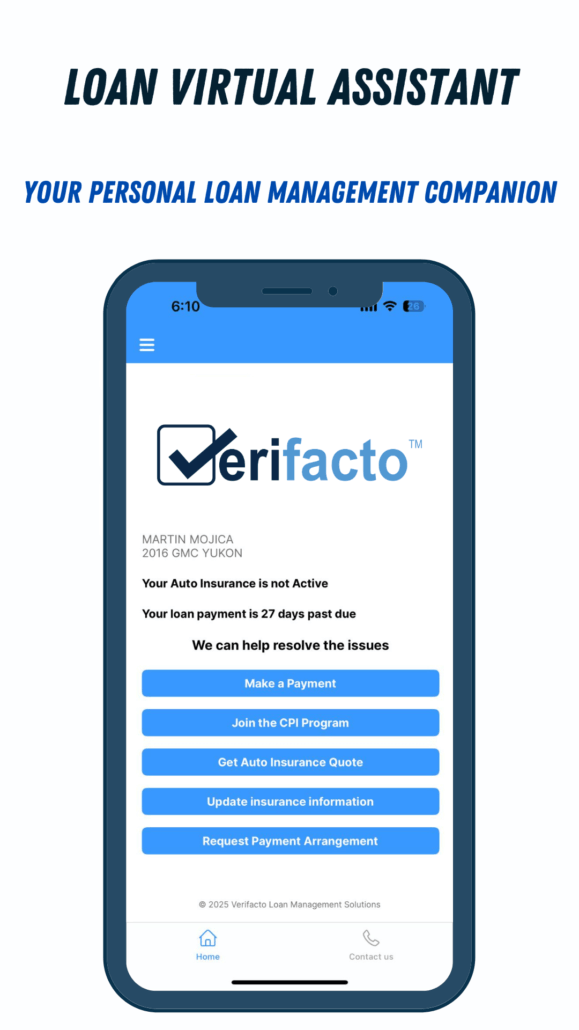

Verifacto’s Loan Virtual Assistant

Traditional loan payments are complicated, outdated, and prone to delays. Verifacto’s Loan Virtual Assistant modernizes the process—giving borrowers an easy way to pay while helping lenders increase on-time payments and reduce operational costs.

With Loan Virtual Assistant , lenders can provide a seamless, automated, and mobile-first payment experience, eliminating the common pain points of traditional loan management

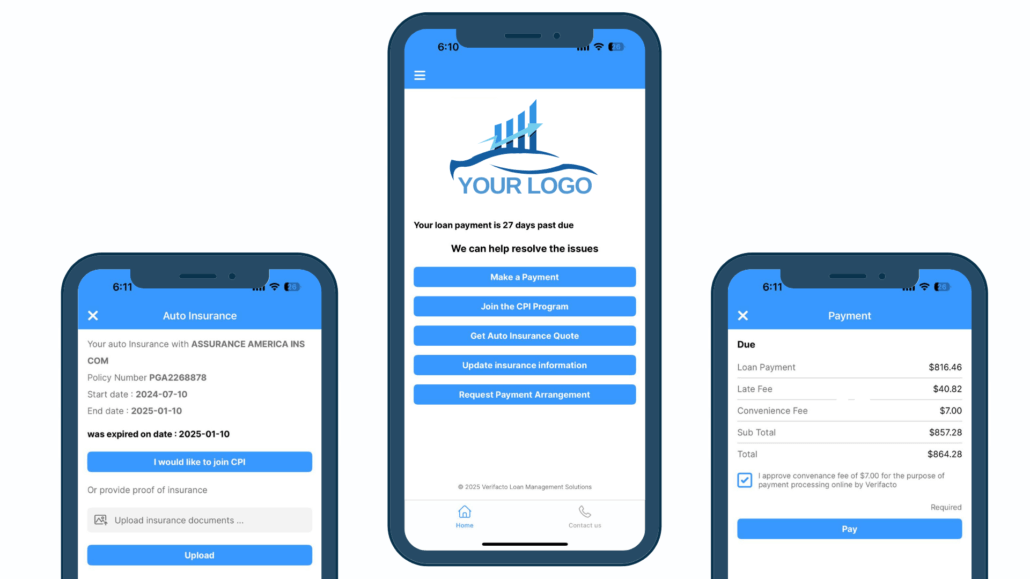

What Can Borrowers Do with Loan Virtual Assistant?

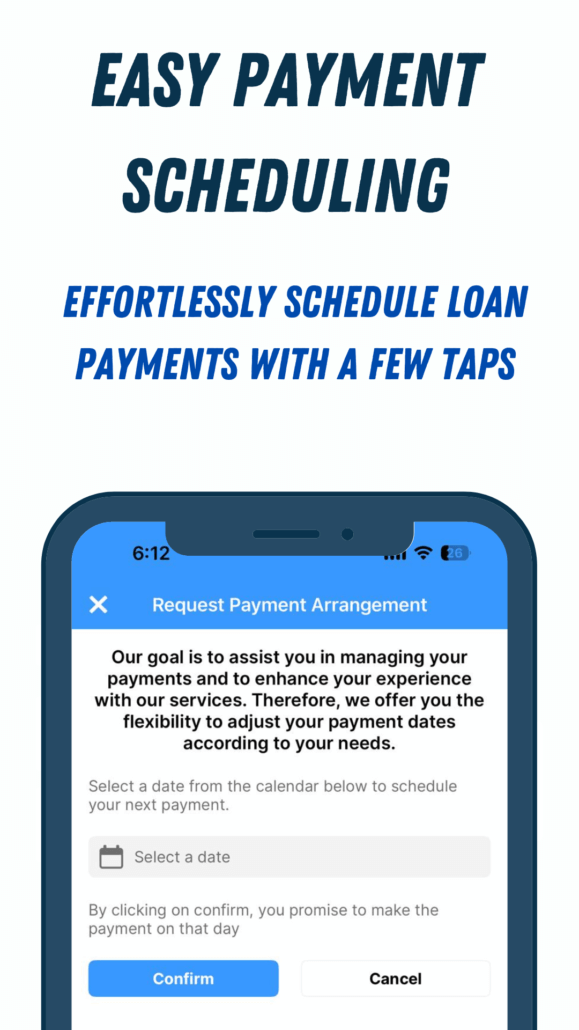

💳 Make and Schedule Payments

One-time or recurring payments with flexible scheduling.

Multiple payment methods including credit/debit cards and ACH transfers.

Instant payment confirmations for real-time tracking and transparency.

🔔 Receive Automated Payment Reminders & Alerts

Personalized alerts via Notifications, SMS, email, and WhatsApp.

AI-driven insights recommend the best time to make payments.

Real-time notifications ensure borrowers never miss a due date.

📌 Manage Loan & Account Details

View loan balance, next due date, and full payment history.

Access loan payoff details for better financial planning.

Secure biometric authentication (Face ID & fingerprint) for easy logins.

🛡️ Update Insurance & Stay Compliant

Upload and manage insurance documents directly in the app.

Automated CPI enrollment ensures compliance with lender requirements.

Receive real-time alerts for missing or expiring insurance policies.

📞 Direct Communication with Lenders

Call, email, or WhatsApp lenders directly from the app.

Request loan modifications, payment extensions, or account updates.

Use self-service options to minimize customer support calls.

Why Verifacto’s Loan Virtual Assistant Stands Out

Unlike traditional payment systems, LVA is built for today’s digital borrowers. Here’s what makes it unique:

AI-powered payment recommendations to boost on-time payments.

Customizable lender settings for tailored borrower interactions.

Seamless CPI integration to automate compliance tracking.

Automated fee adjustments based on state regulations.

The LVA Advantage: Streamlined Loan Management for Lenders & Borrowers

The Loan Virtual Assistant (LVA) is designed to increase on-time payments, reduce operational costs, and improve borrower satisfaction by eliminating the common pain points in traditional loan management.

How Loan Virtual Assistant Benefits You

For Lenders:

✔ Increase On-Time Payments – AI-driven insights and reminders optimize collections.

✔ Lower Delinquency Rates – Borrowers stay on track with proactive engagement.

✔ Optimize Operations – Automation reduces manual workloads and customer support costs.

✔ Enhance Borrower Retention – A modern, mobile-first experience improves borrower loyalty.

For Borrowers:

✔ No More Payment Hassles – No need to remember due dates or navigate clunky portals.

✔ 24/7 Account Access – Manage loans anytime, anywhere with a user-friendly app.

✔ Secure & Fast Payments – Biometric authentication ensures instant and protected transactions.

✔ Stay Compliant – Easily update insurance details and avoid unnecessary fees.

Transform Your Loan Management Today

Borrowers demand simple, flexible, and mobile-first payment solutions—Verifacto’s Loan Virtual Assistant delivers exactly that. With cutting-edge automation and seamless integration, lenders can increase efficiency, reduce costs, and enhance borrower satisfaction.

📅 Schedule a Demo Today to see how LVA can revolutionize your loan payment experience.