Verifacto’s Mobile Loan Management App

Elevating the Borrower Experience with Technology

In today’s fast-paced financial landscape, customer satisfaction and seamless communication are critical to the success of lenders. Verifacto’s Mobile Loan Management App is a game-changing solution designed to empower lenders to provide their borrowers with unparalleled service, ensuring timely payments, increased satisfaction, and long-term loyalty.

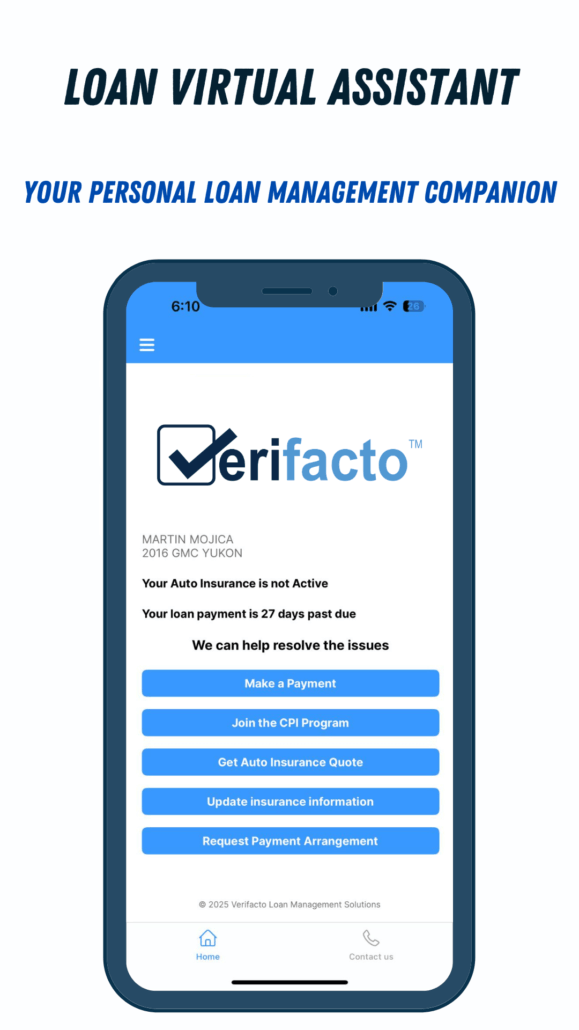

Key Features Designed for Success:

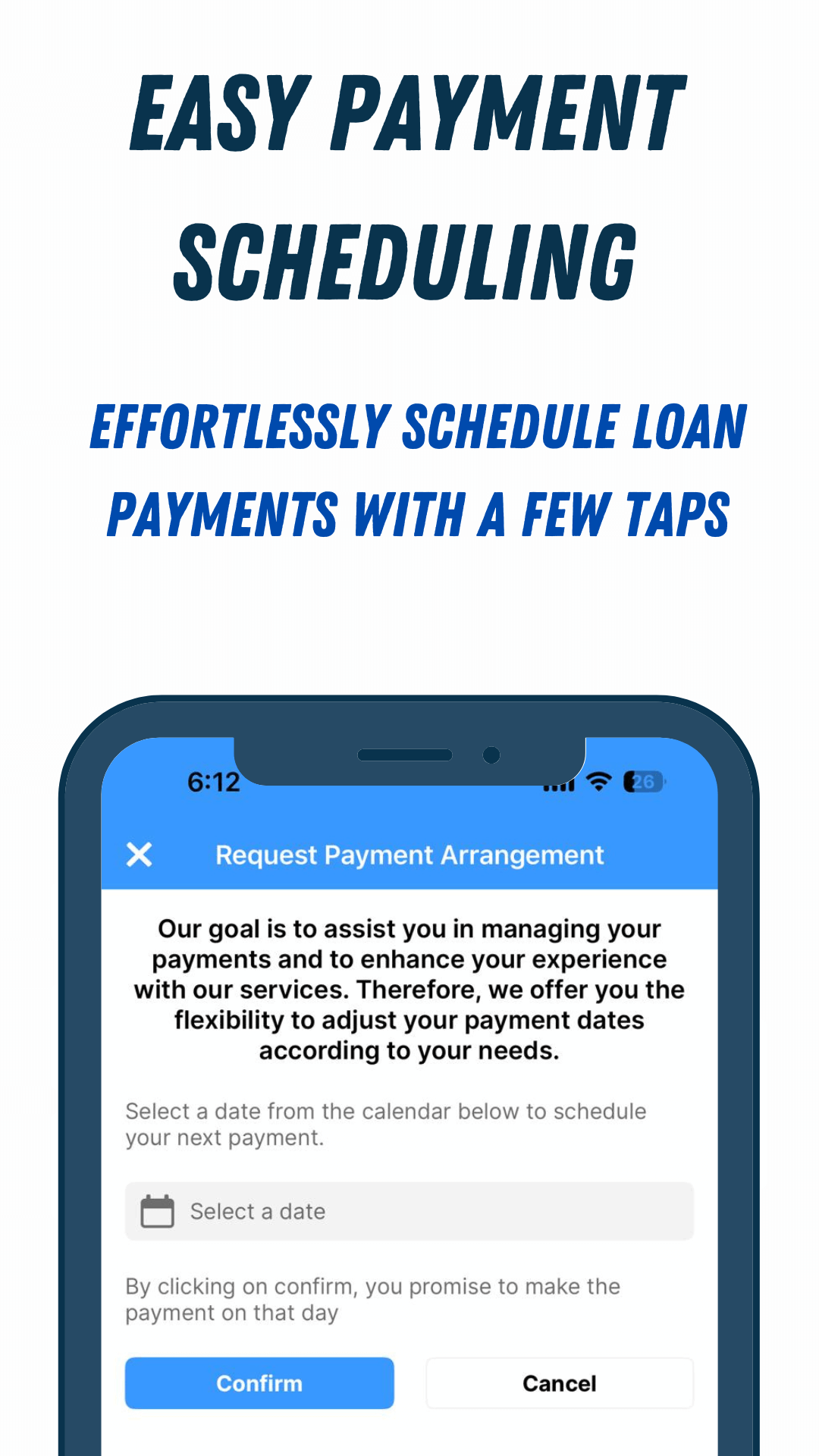

1. Simplified Payment Management:

Enable borrowers to effortlessly make payments or set up payment arrangements directly through the app. Borrowers can:

-

View detailed payment breakdowns, including late fees and total amounts due.

-

Choose from saved payment methods or add new cards securely.

-

Schedule payments with a simple calendar interface based on lender-specific guidelines.

2. Real-Time Insurance Updates:

With built-in insurance management, borrowers can:

-

Update auto insurance documents by uploading photos or selecting files.

-

Join your Collateral Protection Insurance (CPI) program with a single click.

-

Receive notifications about missing insurance details to avoid coverage lapses.

3. Seamless Communication Tools:

Stay connected with borrowers through:

-

Integrated phone, email, and WhatsApp support.

-

Automated reminders and alerts for upcoming payments, insurance updates, or loan milestones.

-

Direct messaging capabilities for instant resolution of borrower queries.

4. Secure Biometric Authentication:

Streamline app access by offering:

-

Biometric login options such as Face ID and fingerprint recognition.

-

Quick and secure account authentication to enhance the borrower experience.

5. User-Centric Design:

From onboarding to daily use, every app feature prioritizes simplicity and efficiency:

-

Borrowers receive personalized links to download and register for the app.

-

Password setup and reset flows are intuitive, minimizing login issues.

-

A profile management section allows borrowers to update personal details that sync seamlessly with your Verifacto portal for lender review and approval.

Why Lenders Choose Verifacto’s App:

1. Reduce Delinquency Rates:

Empower borrowers with tools that make it easy to stay on top of payments. Simplified processes, timely reminders, and clear payment options lead to fewer late payments and better cash flow for your business.

2. Improve Borrower Satisfaction:

Happy borrowers are loyal borrowers. By providing a seamless and convenient loan management experience, you increase the likelihood of repeat business and positive word-of-mouth referrals.

3. Enhance Compliance:

Stay ahead of regulatory requirements with built-in compliance tools. The app’s secure infrastructure ensures borrower data protection and accurate payment tracking, keeping your operations audit-ready.

4. Boost Operational Efficiency:

Automate routine processes like payment tracking, insurance updates, and communication to save time and resources. Let your staff focus on strategic growth instead of manual follow-ups.

Verifacto: Your Partner in Borrower Engagement

At Verifacto, we understand the challenges lenders face in delivering exceptional borrower experiences while managing compliance and operational costs. Our mobile app is more than just a loan management tool—it’s a gateway to building stronger borrower relationships and achieving measurable business outcomes.

Let’s Work Together:

Contact Verifacto today to learn how our Mobile Loan Management App can transform your borrower services and drive success for your lending business.