Verifacto Launches AI-powered Messaging and Communication System for Auto Lenders and Dealerships

In an era where technology is constantly reshaping the way businesses operate, Verifacto is excited to introduce its latest innovation: an AI-powered messaging and communication system. Designed specifically for auto lenders and car dealerships, this cutting-edge tool is set to revolutionize customer interactions, driving efficiency, personalization, and satisfaction to new heights. What Exactly Is AI, […]

Verifacto Achieves SOC 2 Certification: Ensuring Security & Trust in Loan Management

At Verifacto, our commitment to safeguarding customer data and maintaining system resiliency is at the core of everything we do. As a leading provider of Loan Management System (LMS) , Dealer Management System (DMS) and insurance tracking solutions, we understand that data security is critical for our clients in the automotive lending space. That’s why […]

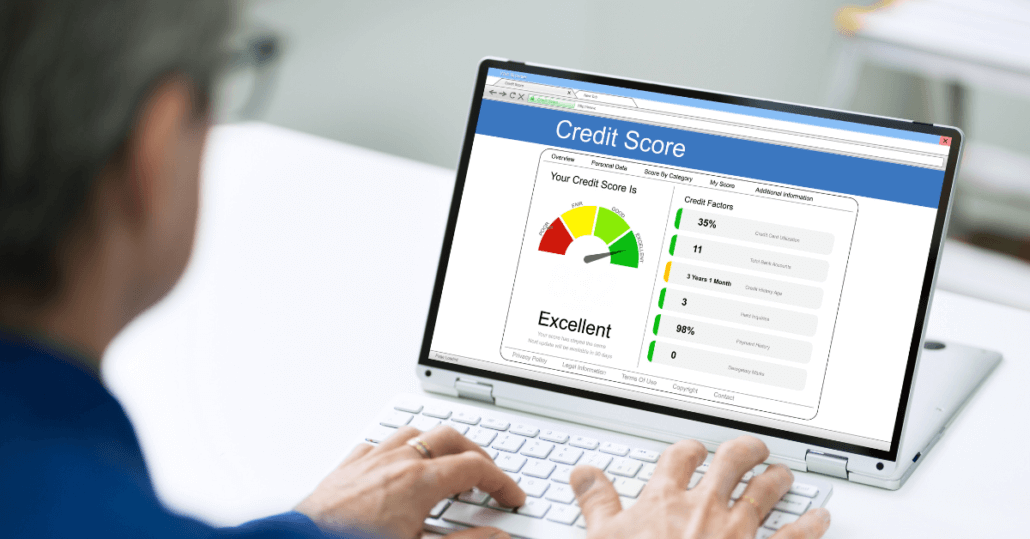

How Verifacto’s Loan Management Solution Enhances Risk Management in Automotive Lending

Effective risk management is crucial for success in the automotive lending industry. Verifacto’s Loan Management Solution (LMS) offers a range of features designed to enhance risk management and protect against potential losses. This blog explores how Verifacto’s LMS helps automotive finance companies manage risk more effectively and why it’s an essential tool for lenders. #### […]

Maximizing Efficiency in Automotive Lending with Verifacto’s LMS

In a highly competitive automotive lending market, efficiency is key to maintaining a competitive edge. Verifacto’s Loan Management Solution (LMS) is designed to enhance operational efficiency and streamline loan management processes. This blog delves into how Verifacto’s LMS helps automotive finance companies achieve maximum efficiency and why it’s an indispensable tool for modern lenders. #### […]

Verifacto Revolutionizes Auto Finance Industry with Smart DMS Underwriting System

Verifacto Verifacto, a leading provider of innovative solutions for the auto finance industry, is thrilled to announce the launch of its groundbreaking Smart DMS Underwriting System. Atlanta, USA, May 16, 2024 (GLOBE NEWSWIRE) — Verifacto, a leading provider of innovative solutions for the auto finance industry, is thrilled to announce the launch of its groundbreaking Smart DMS Underwriting […]

How technology can speed up your auto finance business

Regulatory compliance, product shortages, inflation, and rising prices – these challenges affect all industries, including auto finance. To remain competitive, auto finance business leaders must continue to evolve. Compared to those with an aversion to change, leaders in technology adoption and innovation grew twice as fast before the pandemic. Disruption cannot limit market leaders’ adaptability, […]

How a Loan Management System Can Help Your Dealership

As the owner or operator of an auto dealership, you have several responsibilities you must juggle each day. Between communicating with customers, managing insurance notices, running compliance checks, and more, it is easy to become overwhelmed and unorganized without the right loan management system in place. With loan management software, you can streamline operations and […]

How to Leverage a Smart DMS to Increase Profitability

When owning and operating a dealership, having an effective dealer management system is a must. However, if your business is using an outdated system that lacks the proper tools to promote efficient operations, it leaves you vulnerable to unnecessary overhead costs, which could decrease profits and put your portfolio at risk. However, with Verifacto’s smart […]

What is a Smart DMS?

Almost every dealer uses a dealer management system. It is vital to running your business. The more technology a DMS can provide usually equates to more efficiencies and ultimately more profit for your business. However, most DMS lack the technology that is needed to give you the tools to maximize efficiencies in your business. The […]

What You Need to Know About Collateral Protection Insurance Companies

If you are the owner or operator of a car dealership or auto finance company, you likely face problems with uninsured borrowers. When these drivers get into auto accidents, your business suffers in a few ways. The customer usually stops paying on the loan, which will eventually result in having to pick up the vehicle. […]