The Role of Multi-Channel Communication in Strengthening Borrower-Lender Relationships

In the competitive lending landscape, effective communication is more than a necessity—it’s a strategic advantage. A well-rounded, multi-channel communication strategy not only improves borrower engagement but also reduces delinquencies, increases customer satisfaction, and fosters long-term loyalty. This article explores the key communication channels that lenders should leverage and highlights the transformative power of technology in […]

Navigating Challenges and Embracing Opportunities in Auto Finance

The auto finance industry faces a host of challenges, but these hurdles also open doors for growth and innovation. To remain competitive, lenders are adopting digital tools, including cloud-based loan applications and online payment systems for both new and used vehicles. Regulatory compliance remains a central concern as lenders must navigate an intricate web of […]

Verifacto Launches AI-powered Messaging and Communication System for Auto Lenders and Dealerships

In an era where technology is constantly reshaping the way businesses operate, Verifacto is excited to introduce its latest innovation: an AI-powered messaging and communication system. Designed specifically for auto lenders and car dealerships, this cutting-edge tool is set to revolutionize customer interactions, driving efficiency, personalization, and satisfaction to new heights. What Exactly Is AI, […]

Verifacto Achieves SOC 2 Certification: Ensuring Security & Trust in Loan Management

At Verifacto, our commitment to safeguarding customer data and maintaining system resiliency is at the core of everything we do. As a leading provider of Loan Management System (LMS) , Dealer Management System (DMS) and insurance tracking solutions, we understand that data security is critical for our clients in the automotive lending space. That’s why […]

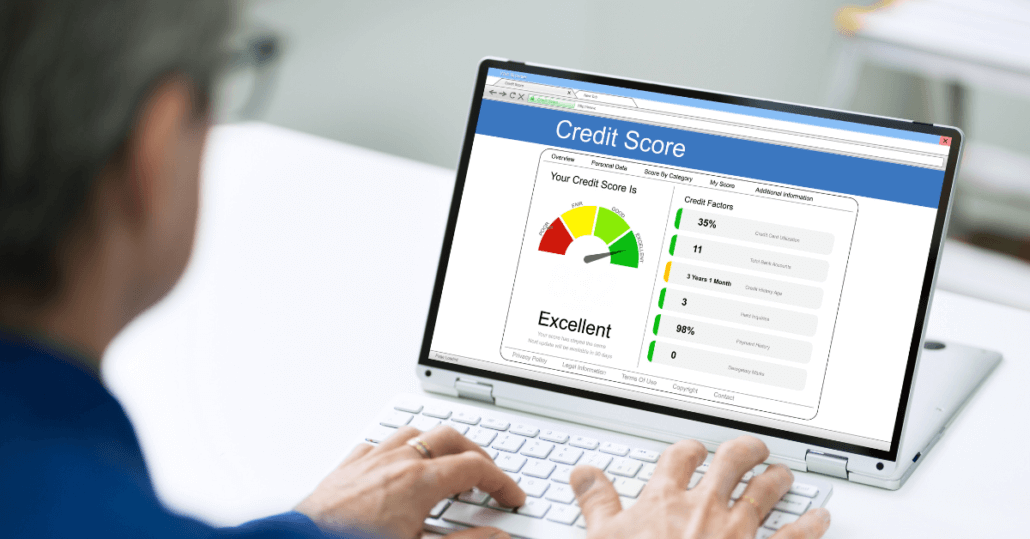

How Verifacto’s Loan Management Solution Enhances Risk Management in Automotive Lending

Effective risk management is crucial for success in the automotive lending industry. Verifacto’s Loan Management Solution (LMS) offers a range of features designed to enhance risk management and protect against potential losses. This blog explores how Verifacto’s LMS helps automotive finance companies manage risk more effectively and why it’s an essential tool for lenders. #### […]

Maximizing Efficiency in Automotive Lending with Verifacto’s LMS

In a highly competitive automotive lending market, efficiency is key to maintaining a competitive edge. Verifacto’s Loan Management Solution (LMS) is designed to enhance operational efficiency and streamline loan management processes. This blog delves into how Verifacto’s LMS helps automotive finance companies achieve maximum efficiency and why it’s an indispensable tool for modern lenders. #### […]

Revolutionizing Automotive Lending with Verifacto’s Loan Management System

In the ever-evolving landscape of automotive lending, the need for a robust, data-driven Loan Management System (LMS) has never been more critical. Enter Verifacto’s Loan Management Solution, a cutting-edge tool designed to streamline and optimize loan processes for automotive finance companies. This blog explores how Verifacto’s LMS stands out in the crowded field of loan […]

Verifacto Revolutionizes Auto Finance Industry with Smart DMS Underwriting System

Verifacto Verifacto, a leading provider of innovative solutions for the auto finance industry, is thrilled to announce the launch of its groundbreaking Smart DMS Underwriting System. Atlanta, USA, May 16, 2024 (GLOBE NEWSWIRE) — Verifacto, a leading provider of innovative solutions for the auto finance industry, is thrilled to announce the launch of its groundbreaking Smart DMS Underwriting […]

The Modern Era of Loan Management Systems

In the age of global digital transformation, industries have experienced a significant positive shift benefiting consumers and businesses alike. Particularly in customer-centric sectors such as consumer lending, this transformation emphasizes improved overall service delivery. While initial efforts focused on automating loan origination, attention has now broadened to encompass loan servicing systems, creating a more comprehensive […]

Verifacto Introduces Verifacto e-Sign to Enhance Smart DMS Capabilities for Auto Dealers

Verifacto introduces Verifacto e-Sign, enhancing its Smart DMS for auto dealerships. This feature streamlines operations, saves time, and improves document management through secure electronic signatures, aligning with evolving customer preferences for online solutions. Visit Verifacto.com for more information. Atlanta, GA, February 25, 2024 –(PR.com)–.Verifacto, a pioneer in providing innovative solutions for auto dealerships, introduces Verifacto […]